Trends moving towards more efficient housing options

Square Footage: On average, Manufactured (Mfg) Homes have 250 more square feet of space

Rent Prices: On average, Mfg homes have cost $511 less than other rental options.

Price Per Square Foot: The average cost per square foot of a Mfg home is $61 less than a traditional built home.

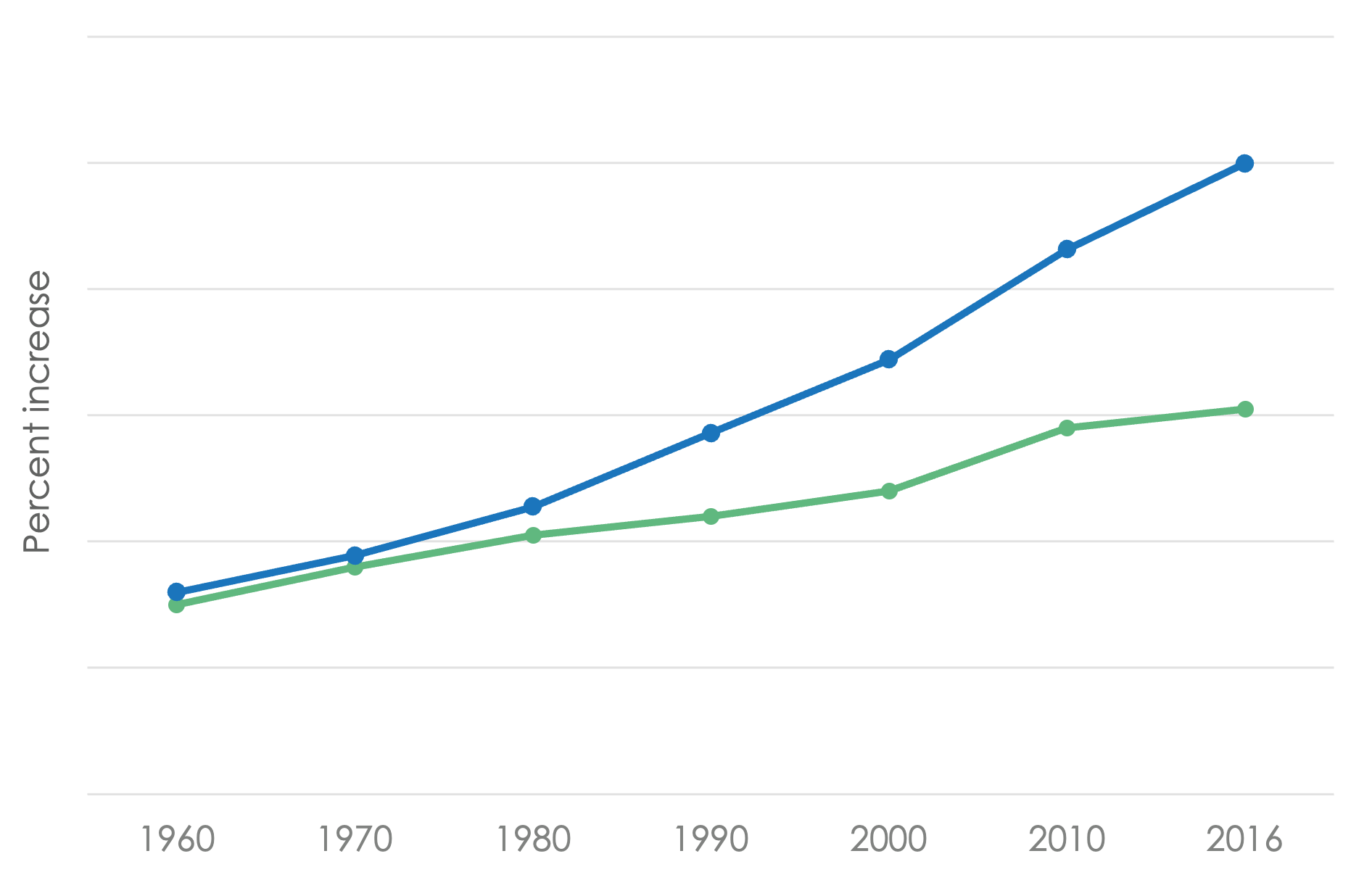

Projected U.S. Population by Generation

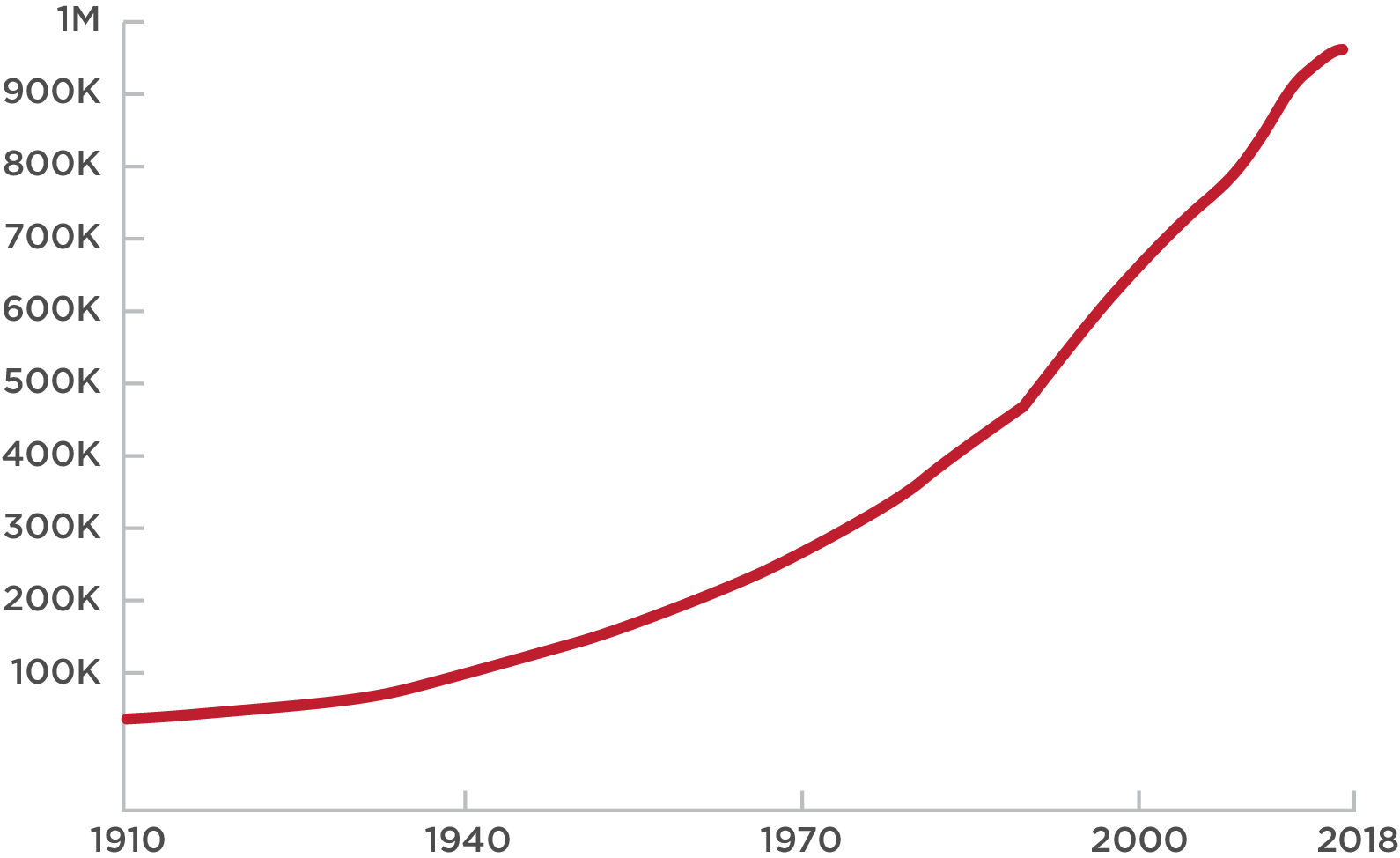

- Texas, with its booming economy, is one of the most desirable states in the US for young workers and retirees.

- Central Texas is one of the most sought after regions in Texas with areas like the Hill Country and availability/access to lakes and rivers.

Millennials

- Millennials are the largest generational demographic for the foreseeable future.

- Manufactured homes today are producing less waste and are more energy-efficient than most site-built homes. For many people in the younger generations, this is a significant draw.

- Millennials are looking to live in smaller homes producing a smaller carbon footprint.

- For the Millennial, the American dream is a wide-open road with plenty of options and flexibility, fitting an RV lifestyle.

Baby Boomers

- Currently, there are more than 70MM Baby Boomers

- The population of people age 55 and older in the U.S. is expected to grow 22% from 2018 to 2033

- There are 10,000 Baby Boomers retiring in the U.S. each day – and a huge number of them are focusing on down-sizing.

- Baby boomers are retiring with little savings and need an affordable option to extend their desired lifestyle choices.

What is an OZ and how do they work?

Opportunity Zones are tax incentives to encourage those with capital gains to invest in low-income and undercapitalized communities.

- Temporary deferral of taxes on previously earned capital gains.

Investors can place existing assets with accumulated capital gains into Opportunity Funds. Those existing capital gains are not taxed until the end of 2026 or when the asset is disposed of. - Basis step-up of previously earned capital gains invested.

For capital gains placed in Opportunity Funds for at least 5 years, investors’ basis on the original investment increases by 10 percent. If invested for at least 7 years, investors’ basis on the original investment increases by 15 percent. - Permanent exclusion of taxable income on new gains.

For investments held for at least 10 years, investors pay no taxes on any capital gains produced through their investment in Opportunity Funds (the investment vehicle that invests in Opportunity Zones).

The CTX Opportunity Funds

Our Strategy

”At the end of last year the stock market cratered nearly 20%. But I found one group of stocks that bucked the trend and actually showed gains when all hell broke loose in the markets.

These stocks pay healthy, reliable dividends and they’ve done better than the S&P 500 every year this decade. These stocks are hidden in the real estate sector and make a certain type of home that’s in high demand. The industry term- manufactured homes.

Robert RossThe Weekly Profit

Why CTX?

With 85+ years of combined industry experience, CTX has built a reputation based on integrity, creative deal structure, and a commitment to creating projects that grow community and honor their strong Texas roots.

Our Services

PROPERTY ACQUISITION

Land development & Entitlements

Asset Management

Construction Management

CTX Team

Craig Benson joined CTX Capital Partners as a General Partner in 2019. Prior to joining CTX, Benson was CEO and President of Rules-Based Medicine, Inc. a life science pharma service/diagnostic company, after directing its spin-off from Luminex Corporation. The business was acquired by Myriad Genetics in 2011. He also served as Chairman of the Board for Equity Resource Partners, LLC, a private investment company and was previously employed by Service Corporation International. During his tenure with SCI, he held various senior executive management positions, which included domestic and international merger and acquisition responsibilities, Vice-President of Marketing and Corporate Alliances, as well as President of SCI International, Ltd., SCI’s International holding company with over $2 billion in overseas operations. Benson also served as President of Investment Capital Corporation, the private equity arm of SCI, which held over $350 million in assets. Early in his career he held management positions with Pulaski Investment Corporation, a bank holding company engaged in commercial and mortgage finance activities.

In addition to his current position with CTX, Benson is a General Partner at Caddo Minerals, Inc., a private energy investment company, and CEO of 4E Therapeutics, Inc. an early stage virtual therapeutic development company.

Outside of the office, Benson is passionate about his work as Founder and Executive Chairman of the Board of Directors of Beyond Batten Disease Foundation (BBDF). BBDF is engaged in therapeutic development and patient advocacy for the juvenile form of Batten Disease. Its lead candidate, BBDF-101, has recently been approved by the FDA to commence clinical trials and has been licensed to a publicly traded pharmaceutical company for further development. He is also a member of the International Advisory Board of the Jan and Dan Duncan Neurological Research Institute at Texas Children’s Hospital, Houston, Texas.

Allen Cowden is an experienced developer and investor with over 20 years of diverse experience in residential, multifamily, ranch and commercial acquisition, construction, development and asset management. He began his career in the trenches of residential construction in Austin, learning the business from the ground up. His financial and deal experience was established while working for two of the nation’s premier real estate companies, The Archon Group (Goldman Sachs) and the Staubach Company, working on office and industrial asset management and development, single tenant transactions, and 1031 exchanges. After leaving the Staubach Company in 2001, Cowden founded a development and investment company, which led him into a partnership Austin-based Centro Partners, specializing in urban condo, multifamily and mixed-use development, including The Domain in north Austin.

Cowden continues to operate effectively through strategic partnerships with like minded investors across commercial, urban multifamily, and ranch land acquisitions and development. Over the last 12 years, Allen has concentrated on developing the $200MM mixed-use Seaholm Power Plant Project in downtown Austin as a principal in Seaholm Power, LLC. He was instrumental in Seaholm’s City of Austin public-private partnership negotiations and helped oversee the financial structuring, equity partnerships, residential tower design and condominium sales and closings. In addition, Cowden also heads up several oil & gas companies, managing in excess of $100MM in mineral, royalty and working interest assets.

Landon Durham is a seasoned asset manager and dispositions specialist in both the real estate and oil and gas sectors. Durham began his career by building and operating an online auction services and technology company. From there, Durham launched into multi-family and student housing investment, focusing on investment modeling and strategy, distressed debt takeovers, conventional multifamily and mixed-use acquisitions, asset management and dispositions.

His initial foray into real estate acquisitions modeling and deal analysis was established while working at TVO North America (Chicago, IL), where he quickly assumed the role of senior acquisitions analyst and asset manager. At TVO North America he was instrumental in overseeing a nationwide real estate acquisitions strategy, as well as assisting company partners with the disposition strategy for in place assets. After leaving TVO North America, he joined San Miguel Management (Austin, TX), where he played a key role in the repositioning and disposition of 6 distressed multifamily assets in Jacksonville, Florida, consisting of a multimillion dollar renovation of 1,845 units. Most recently as Vice-President of Investments at State Street Asset management, Durham oversaw the asset management of $100MM in real estate and oil & gas assets, and participated on the $200MM Seaholm Power Plant and Residences development.

Durham attends Life Austin Church and lives in Austin with his wife and 4 kids.

Josh Thornton has over 20 years of property and project management experience. Over the last 13 years, Thornton has managed multi-phased projects in the Austin area totaling 84mm, across all phases, including, architect selection, conceptual design, contractor selection, construction management, and facilities management of the final product. He also oversees selection of materials, products, and systems for all projects.

Thornton is experienced at managing property teams, development budgets, and has a vast knowledge of City, County, and State codes and ordinances. In addition, he possesses in-depth knowledge of the granular needs for commercial development. Including, HVAC and HVAC EMS, lighting systems, e-access doors, security and cameras systems, fire protection and suppression, elevators, plumbing, electrical, welding, metal framing, sheetrock, painting, roofing, waterproofing systems, large sewage systems, water detention and water quality ponds, site work, drainage, landscaping and more.

Before his commercial property career, Thornton helped run a landscaping company, ranch management company, and managed research greenhouses. He also manages his family’s cattle ranch in Llano, TX.

Michael Tucker

Samuel Levatino